A practical walkthrough on calculating the FEIE Standard Deduction

All Regarding the Foreign Earned Income Exemption: Optimizing Your Standard Deduction Advantages

The Foreign Earned Earnings Exemption (FEIE) offers a beneficial possibility for U.S. people living abroad to minimize their tax obligation liabilities. Comprehending the qualification criteria is vital for those seeking to benefit from this exemption. Additionally, declaring the typical deduction can boost overall tax benefits. Handling this process includes careful focus to detail and a recognition of usual pitfalls. Checking out these elements can supply quality and optimize potential tax advantages.

Recognizing the Foreign Earned Earnings Exemption (FEIE)

The International Earned Earnings Exclusion (FEIE) allows united state citizens and resident aliens functioning abroad to omit a section of their international profits from government earnings tax. This arrangement functions as a financial relief mechanism, making it possible for expatriates to preserve a bigger share of their earnings made in international nations. By lowering gross income, the FEIE aids alleviate the concern of dual tax, as individuals may additionally go through taxes in their host nations. The exclusion uses just to earned income, which consists of incomes, wages, and expert fees, while passive earnings and financial investment gains do not qualify. To profit from the FEIE, individuals should submit particular kinds with the internal revenue service, detailing their international revenues and residency - FEIE Standard Deduction. Understanding the subtleties of the FEIE can significantly influence monetary planning for U.S. people living overseas, making it necessary for expatriates to stay notified concerning this useful tax arrangement

Qualification Requirements for the FEIE

To qualify for the Foreign Earned Revenue Exemption (FEIE), individuals have to meet particular qualification standards. This consists of enjoyable residency needs, passing the physical existence examination, and developing a tax home in an international nation. Each of these aspects plays a vital duty in establishing whether one can gain from the exclusion.

Residency Requirements

Satisfying the residency requirements is essential for individuals seeking to get approved for the Foreign Earned Revenue Exemption (FEIE) To be eligible, taxpayers need to establish an authentic house in a foreign country or nations for a continuous period that generally covers an entire tax year. This need highlights the necessity of a deeper connection to the international area, relocating beyond simple physical existence. People should demonstrate their intent to reside in the foreign nation and have established their living circumstance there. Variables such as the length of remain, type of real estate, and local area participation are considered in determining residency. Meeting these requirements is crucial, as failure to do so may disqualify one from benefiting from the FEIE.

Physical Existence Examination

Establishing qualification for the Foreign Earned Revenue Exclusion (FEIE) can additionally be achieved through the Physical Visibility Examination, which requires individuals to be literally existing in a foreign country for at least 330 complete days throughout a consecutive 12-month duration. This examination is useful for those that may not meet the residency need yet still stay abroad. The 330 days must be complete days, meaning that any kind of day invested in the USA does not count toward this overall. It is necessary for people to keep exact records of their traveling dates and places to sustain their insurance claims. Efficiently passing this test can significantly minimize taxed revenue and enhance monetary results for migrants.

Tax Home Location

Tax obligation home area plays an important duty in identifying eligibility for the Foreign Earned Income Exclusion (FEIE) To certify, a specific need to develop a tax home in an international country, which implies their key business is outside the USA. This is distinctive from a mere house; the private need to conduct their operate in the international nation while keeping a considerable link to it. The internal revenue service requires that the taxpayer can demonstrate the intent to remain in the international area for an extensive duration. In addition, preserving a home in the U.S. can complicate qualification, as it might suggest that the person's real tax obligation home is still in the United States. Understanding this requirement is vital for taking full advantage of FEIE advantages.

Exactly how to Assert the FEIE on Your Income Tax Return

Asserting the Foreign Earned Revenue Exclusion (FEIE) on an income tax return needs mindful attention to information and adherence to particular internal revenue service guidelines. Taxpayers more must first verify qualification by fulfilling either the bona fide residence test or the physical existence test. When eligibility is validated, they have to finish internal revenue service Kind 2555, which details international gained income and relevant information concerning their tax obligation home.

It is crucial to report all international income precisely and preserve ideal documents to sustain insurance claims. Taxpayers ought to likewise be mindful of the optimal exemption restriction, which is subject to annual modifications by the internal revenue service. Declaring Kind 2555 alongside the yearly income tax return enables taxpayers to exclude a part of their international earnings from U.S. tax. It is a good idea to speak with a tax obligation specialist or Internal revenue service resources for updated info and support on the FEIE process, guaranteeing compliance and maximization of prospective advantages.

The Criterion Reduction: What You Required to Know

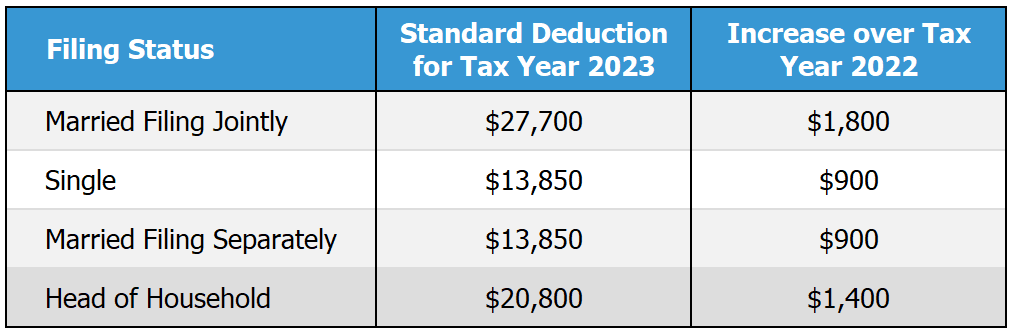

How does the common reduction impact taxpayers' total financial circumstance? The typical deduction functions as a considerable tax benefit, decreasing gross income and potentially reducing tax obligation liabilities. For the tax obligation year 2023, the common deduction is established at $13,850 for solitary filers and $27,700 for wedded pairs filing collectively. This reduction simplifies the declaring procedure, as taxpayers can choose for it as opposed to itemizing deductions, which needs in-depth record-keeping.

Taxpayers gaining international income may still claim the typical reduction, gaining from reduced taxed earnings also while using the Foreign Earned Revenue Exclusion (FEIE) However, it is important to keep in mind that the common deduction can not be integrated with itemized reductions for the same tax obligation year. Comprehending the typical reduction enables taxpayers to make educated decisions regarding their tax methods, maximizing offered advantages while guaranteeing compliance with IRS laws.

Methods for Maximizing Your Reductions

Making the most of reductions under the Foreign Earned Earnings Exemption calls for a clear understanding of made income restrictions and the benefits of claiming real estate exemptions. In addition, using Form 2555 efficiently can boost the potential for substantial tax obligation cost savings. These techniques can significantly impact the general tax responsibility for expatriates.

Understand Made Earnings Restrictions

While several expatriates seek to reduce their tax burden, recognizing the gained revenue limitations is vital for effectively leveraging the Foreign Earned Revenue Exemption. The Irs (INTERNAL REVENUE SERVICE) establishes particular thresholds that dictate the maximum amount of foreign gained earnings eligible for exemption. For the tax year 2023, this limitation is $120,000 per certified person. Surpassing this threshold might cause taxes on the revenue over the limit, decreasing the advantages of the exclusion. To maximize reductions, migrants must maintain precise records of their international gained income and examine their qualification for the exclusion every year. Strategic intending around these limitations can greatly improve tax obligation cost savings, permitting expatriates to optimize their monetary scenario while living abroad.

Asserting Housing Exclusion Perks

Numerous migrants overlook the possible advantages of declaring the Real estate Exclusion, which can greatly decrease their taxable revenue. This exemption allows people living abroad to subtract certain housing expenditures from their gross revenue, making it much easier to meet monetary commitments without incurring significant tax obligation liabilities. To optimize this advantage, expatriates must verify they qualify based upon their residence and work scenarios. Additionally, recognizing qualified expenditures-- such as lease, utilities, and maintenance-- can enhance the overall deduction. Keeping thorough documents of these expenses is important for validating cases. By tactically navigating with the Housing Exclusion, expatriates can especially reduce their tax obligation worry and maintain even more of their earnings while living overseas, ultimately enhancing their economic well-being.

Make Use Of Type 2555 Effectively

Using Form 2555 effectively can greatly boost the financial benefits readily available to migrants, specifically after making use of the Real estate Exemption. This form enables people to claim the Foreign Earned Earnings Exemption, which can considerably lower gross income. To optimize deductions, migrants should confirm they meet the credentials, consisting of the physical existence test or the bona fide home test. It is important to properly report all international earned income and to keep thorough documents of qualification. Additionally, utilizing the Real estate Exemption in tandem with Form 2555 can even more decrease overall tax obligation. By comprehending the complexities of these types, expatriates can optimize their tax circumstance and keep even more of their hard-earned revenue while living abroad.

Common Risks to Avoid When Filing Your Tax Obligations Abroad

Regularly Asked Questions

Can I Declare Both FEIE and the Foreign Tax Credit Score?

Yes, a person can declare both the Foreign Earned Revenue Exemption (FEIE) and the Foreign Tax Obligation Credit Scores (FTC) They must guarantee that the exact same earnings is not used for both benefits to avoid double benefits.

What Happens if I Exceed the FEIE Revenue Limit?

Surpassing the Foreign Earned Income Exemption (FEIE) revenue restriction results in the ineligibility for the exclusion on the excess quantity. This can cause taxable income in the USA, needing proper tax obligation filings.

Exist Any State Tax Obligation Effects for FEIE?

State tax obligation implications for the Foreign Earned Revenue Exclusion (FEIE) differ by state. Some states may tire foreign earnings while others adhere to federal exemptions, making it necessary for individuals to speak with state-specific tax obligation policies for quality.

How Does FEIE Impact My Social Protection Advantages?

The Foreign Earned Earnings Exemption (FEIE) does not directly affect Social Protection benefits. Nevertheless, revenue left out under FEIE may influence the calculation of average indexed monthly earnings, potentially affecting future benefits.

Can I Revoke My FEIE Political Election After Declaring It?

Yes, a person can withdraw their Foreign Earned Earnings Exclusion (FEIE) more information election after claiming it. This retraction needs to be carried out in composing and sent to the internal revenue service, adhering to certain standards and target dates.

Comprehending the Foreign Earned Revenue Exemption (FEIE)

The Foreign Earned International Exclusion RevenueExemption) allows U.S. enables united state resident aliens working abroad to exclude an omit of part foreign earnings from incomes income government. Taxpayers making international income may still assert the common deduction, benefiting from lowered taxable revenue even while using the Foreign Earned Revenue Exemption (FEIE) Making the most of reductions under the Foreign Earned Income Exemption calls for a clear understanding of gained revenue limits and the advantages of claiming housing exemptions. While lots of expatriates look for to minimize their tax obligation burden, recognizing the made earnings restrictions is vital for properly leveraging the Foreign Earned Revenue Exclusion. Going Beyond the Foreign Earned Earnings Exemption (FEIE) income limitation results in the ineligibility for the exemption on the excess amount.